How To Check Road Tax Price Malaysia

Vehicles with a valid road tax are required to have them displayed. YOU MUST CHECK that the booking for an overnight stay and not day use.

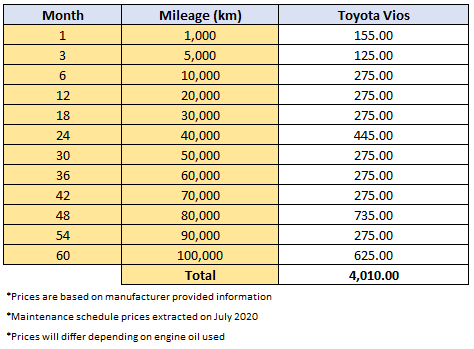

2020 Toyota Vios About Rm 4 000 To Maintain It Over 5 Years 100 000 Km Wapcar

Hence it is easier for you to remember when the license expire.

How to check road tax price malaysia. Volkswagen Passenger Cars Malaysia Sdn Bhd reserves the right to change prices and specifications without prior notice. ANSWERS 10 Priyank Nirula 3 months ago. If the ultimate consumer is a business that collects and pays to the government VAT on its products or services it can reclaim the tax paid.

Chargeable income RM20000. E Moses Road Mahalaxmi West Mumbai 400011. Want to receive greater assurance on securing a loan for your new home.

Min 5 Lacs 10 Lacs 15. Mumbai Urmi Axis Building Ground Floor Behind Famous Studio Opp. By Tom Varghese 2 years ago 87155 views Share Report Abuse.

In its current avatar it comes with a 22-litre mHawk diesel engine and a 20-litre turbocharged petrol engine. It is levied on the price of a product or service at each stage of production distribution or sale to the end consumer. A value-added tax VAT known in some countries as a goods and services tax GST is a type of tax that is assessed incrementally.

The vehicle registration number road tax price and road tax expiry date are clearly written on the road tax sticker. Total tax amount RM150. Also note that all Malaysia hotels will add on a 10 MYR night tourism tax for non-citizens except Tune Hotel will waive the fee for Malaysia Permanent Residents.

Personal Tax 2021 Calculation. We would like to show you a description here but the site wont allow us. Unauthorised modifications are not covered by warranty.

Tax benefits can be availed on premiums paid - investors can receive up to 13rd of the accumulated value on retirement date as a tax-free lump sum as per prevailing income tax laws. H ow can I check land details with this number. Company registration fee is RM500.

The Mahindra Thar is one of the most popular badges in India right now. Budget 2021 Stamp Duty Exemption For First-Time Buyers. What if you forget to renew driving license Malaysia after it expires.

Take for instance an iPhone with a retail price of RM 319900 Phone Purchased on Retail Price RM. Company registration road tax one year is double the amount of private registration road tax. As long as you notice which birthday you are good to go.

New Delhi Shivaji Stadium Metro Station. For cars and trucks the road tax sticker is displayed on the bottom right corner of the windscreen. This was not clear in the Agoda booking page but I was able to upgrade with Agodas help.

Ali work under real estate company with RM3000 monthly salary. It costs RM30 for one year of renewal. Check out our PropertyGuru Loan Pre-Approval here with a 99 accuracy rate.

In Malaysia the road tax is paid on an annual basis. Hyderabad 8-2-700 Ground floor Srida Anushka Pride Opposite Ratnadeep Super Market Banjara Hills Road No12 Hyderabad 500 034. 1842 Rajdanga Main Road Kasba Kolkata-700107.

Total tax reliefs RM16000. Annual income RM36000. Chargeable income less than RM35000 can get a RM 400 tax rebate so Ali does not need to pay any tax amount to LHDN.

For example renew driving license Malaysia for 3 years will be RM30 x 3 RM90. The prices of the phones are subsidised by the telco so getting a smartphone plan could save you money in the long run compared to buying the phone from the retailer at retail price and then subscribing to a comparable mobile plan later. The rental income commencement date starts on the first day the property is rented out whereas the actual rental income itself is assessed on a receipt basis.

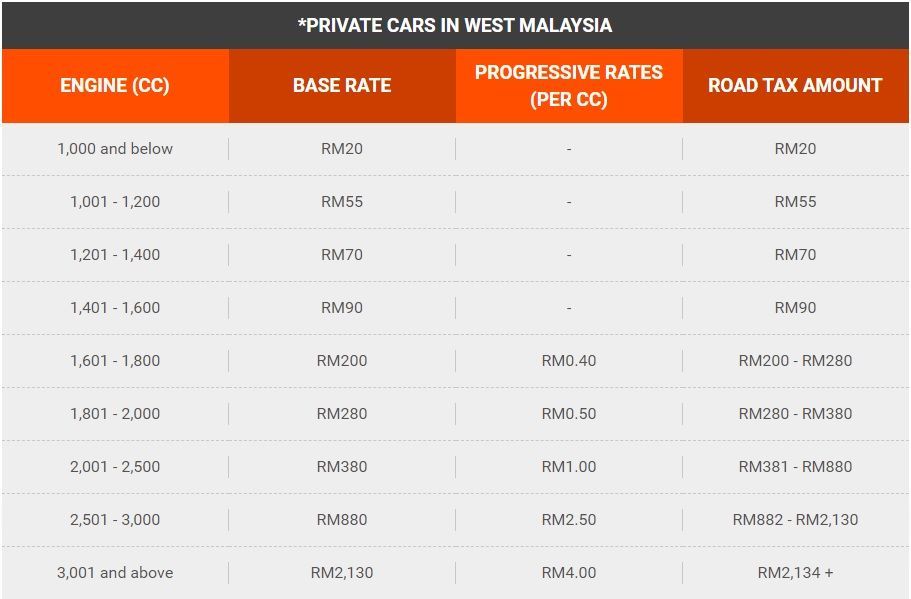

To check the road tax price for your scooter or any motorcycle regardless of the model you just need to know the engine capacity cc of your motorcycle and refer to the road tax price table that we for comprehensive coverage or third party coverage all you have to do is click the GET QUOTE button and proceed to fill in a few details about your motorcycle and yourself. Announced changes to stamp duty in Malaysia mean that first-time buyers are now exempt from certain stamp duty charges. Rental income in Malaysia is taxed on a progressive tax rate from 0 - 28.

The latest travel information deals guides and reviews from USA TODAY Travel. Unfortunately fine will be imposed. The investor can also keep a track of his or her ICICI Prudential life insurance policy status online.

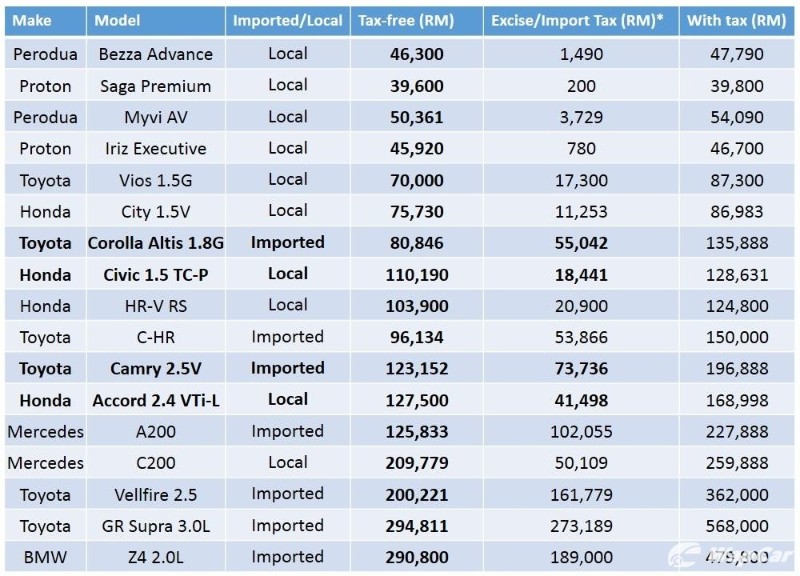

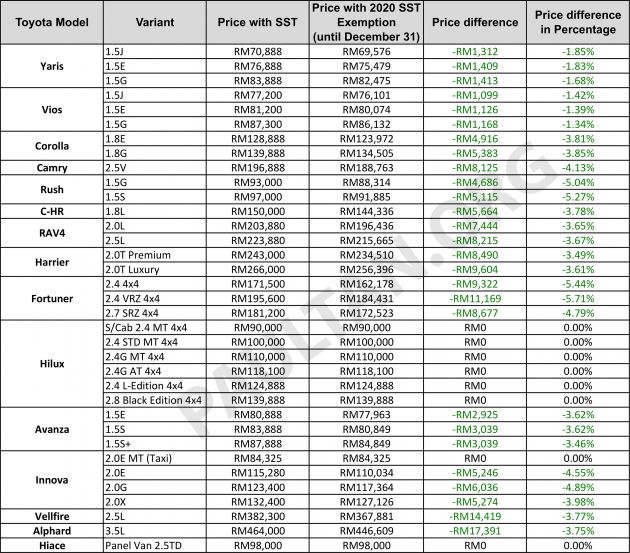

2020 Sst Exemption All The Revised Car Price Lists Paultan Org

Malaysians Pay Over Rm 10 Billion In Car Taxes Every Year How Did We End Up Like This Wapcar

Malaysians Pay Over Rm 10 Billion In Car Taxes Every Year How Did We End Up Like This Wapcar

All You Need To Know About Road Tax Classic Car Status Insights Carlist My

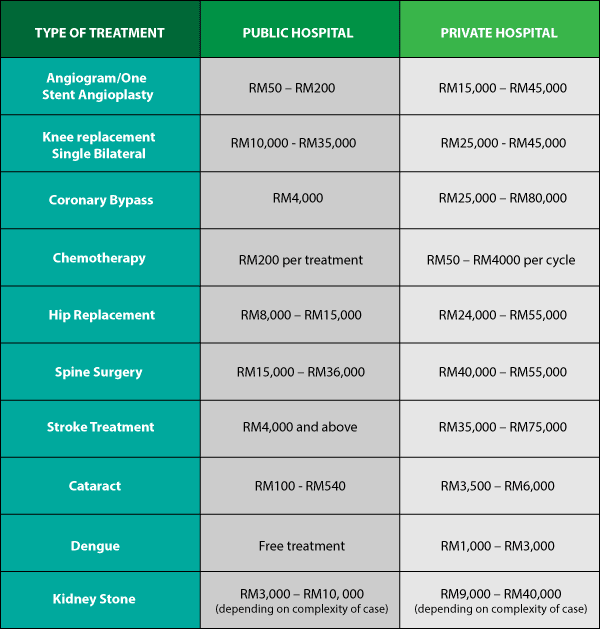

Government And Private Hospitals In Malaysia How Much Do They Really Cost

2020 Sst Exemption All The Revised Car Price Lists Paultan Org

How Much Do You Know About Malaysian Road Tax

Volvo Car Malaysia Releases New Price List Up To Rm23k Savings Carsifu

No Claim Discount Ncd The Complete Guide For Malaysia Car Owners

2020 Sst Exemption All The Revised Car Price Lists Paultan Org

2020 Sst Exemption All The Revised Car Price Lists Paultan Org

Car Road Tax Calculator In Malaysia Wapcar

Posting Komentar untuk "How To Check Road Tax Price Malaysia"